Table of Contents

Toggle

Do you need to collect debts or money owed to you?

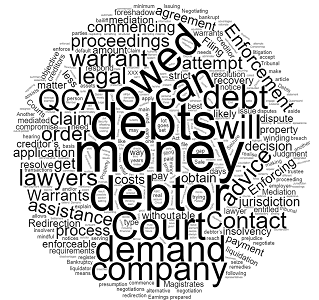

You can recover debts or money owed in the following ways:

- Negotiating with the debtor;

- Mediation or alternative dispute resolution;

- Filing a claim in the Court with jurisdiction;

- Filing a claim in QCAT or another tribunal;

- Issuing a statutory demand on an insolvent company;

- Enforcing the judgment with an enforcement warrant;

- Enforcing the judgment with bankruptcy or liquidation.

In this article our debt recovery solicitors will explain each of the above and give you information on the best way to recover debts or money owed by a person or debts or money owed by a company.

DEDICATED FOCUS – COMMERCIALLY MINDED – PROVEN RESULTS

OR CALL: 1300 545 133 FOR A PHONE CONSULTATION

Recovering Debts or Money Owed by Negotiating

In the first instance, when trying to recover debts or money owed, we recommend trying to resolve the debt matter by negotiating with the debtor.

Non-payment of debts or money owed to you is very likely a breach of contract, and as such you will be entitled to legal (or equitable) remedies. You can certainly highlight those remedies and foreshadow any relief that you will be entitled to as leverage on your side of the negotiation process.

Be mindful not to foreshadow relief that you are not entitled to!

You can’t tell the debtor that you will issue a statutory demand if the amount of the debt is below the statutory minimum.

Likewise, you cannot foreshadow bankruptcy if any future judgment would be less than the statutory minimum for a bankruptcy notice … and so on.

This is essentially what we do in a letter of demand.

Recovering Debts or Money Owed by Compromise or Settlement

As in any negotiation, there is an element of compromise. To reach a resolution, you may be prepared to compromise for the debt and accept a lesser amount.

The rationale for this is because if you are forced to go to Court or engage a debt recovery solicitor, then an award of costs (if any) will likely not cover the actual costs that you have spent, leaving a gap which you will be out-of-pocket.

If this gap is $2,000.00 for example, then you may be prepared to accept something up to $2,000.00 less than the debts or money owed in an attempt to resolve the matter early.

If the debtor accepts a $1,000.00 reduction in the debts or money owed, then this should not be seen as a $1,000.00 loss, but a $1,000.00 win because you are not put to the cost, stress, and time of commencing legal proceedings.

Part of the job of to provide debt recovery services is to advise our clients on the commercial realities of their debt recovery matter.

These compromise negotiations are conducted on a without prejudice basis. See our article here on settling matters early.

Mediation or Alternative Dispute Resolution

If negotiations fail, or do not yield a satisfactory result, then you can attempt to mediate or attempt another form of alternative dispute resolution.

Mediation is a good way of attempting to resolve disputes without resorting to litigation through the Court system and incurring those costs.

A mediation is a structured process where an objective third-party mediator assists to resolve the disputes over debts or money owed.

The objective of the mediation is to reach an agreement and get the parties to sign a legally binding mediated agreement.

Of course, the debtor still needs to pay the debts or money owed after the mediated agreement is made. If the debtor has breached one agreement by not paying the debts or money owed, then you should be mindful that the debtor could quite easily breach the mediated agreement too.

Recovering Debts or Money Owed – Filing a Claim in the Court

If all else fails, then you are able to commence legal action in the Court with jurisdiction.

The Courts have a monetary jurisdiction for debts or money owed:

- Magistrates Court – up to $150,000.00

- District Court – from $150,000.00 to $750,000.00

- Supreme Court – over $750,000.00

Proceedings to recover debts or money owed are commenced by filing and serving a claim and statement of claim.

If the debtor does not respond to your claim by filing and serving a defence within 28 days, then you can get judgment in default and commence enforcement proceedings.

If the debtor attempts to defend your claim or counterclaim, then you will likely be involved in protracted litigation unless you can obtain a summary judgment, or the parties agree to settle the matter and discontinue the proceedings.

The objective is to get a judgment or enforceable money order which you can enforce on the judgment debtor to force the debtor to pay their debts or money owed to you.

Another way to get an enforceable money order is to register a QCAT decision in the Magistrates Court.

Filing a Claim in QCAT or Another Tribunal

If you have a minor debt of under $25,000.00 then you can file a proceeding in the Queensland Civil and Administrative Tribunal (“QCAT”).

Similar to proceeding in the Courts, you must file and serve a QCAT application on the debtor. If they respond, then it goes to a mediation and/or a hearing and the QCAT Member will decide on the amount of debts or money owed to you.

If the debtor does not respond, then you are able to obtain a decision in default.

The main advantages of commencing proceedings in QCAT are:

- It is a lot less expensive than commencing in the Court;

- The process can be a lot faster than the Court; and

- QCAT is designed for self-represented people.

The main disadvantages of commencing proceedings in QCAT are:

- The minor debt jurisdiction is mostly a no costs jurisdiction. This means that you will not be able to recover your costs save for a few designated items;

- Legal representatives do not have an automatic right of appearance. This means that if you want us to appear at a QCAT hearing, you will need the leave of the tribunal, which is not always given.

Once you obtain a decision in QCAT, you can register that decision in the Magistrates Court and it becomes an enforceable money order which can be enforced on the judgment debtor.

Enforcing the Judgment with an Enforcement Warrant

If you get an enforceable money order, then you can attempt to enforce that order with one of a number of different enforcement warrants. The most common types of enforcement warrants are:

- Enforcement Warrants for Seizure and Sale of Property;

- Enforcement Warrants for Redirection of Debts; and

- Enforcement Warrants for Redirection of Earnings.

I will explain these in a little more detail below

Enforcement Warrants for Seizure and Sale of Property

A warrant for seizure and sale of property allows the Court bailiff to seize and sell personal and real property of the enforcement debtor.

The warrant relates to vehicles and real property predominately. There are some strict requirements when applying for this type of enforcement warrant, and the bailiff is unable to seize exempt property.

Enforcement Warrants for Redirection of Debts

A warrant for redirection of debts directs a third party to make payment that are due to be paid to the enforcement debtor to the enforcement creditor.

Again, there are strict requirements for this type of warrant and it is best to obtain legal advice.

Enforcement Warrants for Redirection of Earnings

A warrant for redirection of earnings is a warrant directed at the enforcement debtor’s employer. It orders that the employer direct the ordered amount of the enforcement debtor’s salary to be paid to the enforcement creditor as payment of the debts or money owed under the judgment or money order.

Again, there are strict requirements for this type of warrant and it is best to obtain legal advice from a suitably qualified debt recovery lawyer.

Recovering Debts or Money Owed with Bankruptcy

If your debtor is a person (not a company) and you have a judgment of over $10,000.00 which is less than six (6) years old, then you can apply to the Official Receiver – the Australian Financial Security Authority (“AFSA”) for a bankruptcy notice.

The debtor has 21 days to comply with the bankruptcy notice or he/she would have committed an “Act of Bankruptcy”.

It is this act of bankruptcy which allows you to present a creditor’s petition to the Federal Circuit Court for a sequestration order making the debtor bankrupt.

The bankruptcy process involves the appointment of a bankruptcy trustee to administer the bankrupt estate of the debtor in an attempt to recover the debts or money owed to creditors.

The bankruptcy usually lasts for three (3) years. In this time the bankruptcy trustee can void transactions and attempt to realise assets to pay a divided to creditors.

Recovering Debts or Money Owed by Issuing a Statutory Demand

The it is a company that has the obligation to pay the debts or money owed, and the debts or money owed is over $4,000.00 then you can issue a creditor’s statutory demand on the debtor company.

A creditor’s statutory demand is a demand for payment pursuant to section 459E of the Corporations Act 2001 (CTH).

You do not need a judgment to be able to issue a statutory demand, however if there is a genuine dispute about the debt, or the debtor company has an offsetting claim, then a statutory demand without a judgment could be set aside.

The debtor company has 21 days after being served with the statutory demand to do any of the following:

- Pay the debt or debts in the statutory demand; or

- Secure or compound for the debt in the statutory demand; or

- Request that the demand is withdrawn; and/or

- Apply to set the demand aside.

If the debtor company does not do any of these things, then they are presumed to be insolvent and you can apply to wind the debtor company up in insolvency to recover the debts or money owed to you.

Enforcing the Judgment with Winding Up & Liquidation

As mentioned above, non-compliance with a statutory demand raises the legal presumption of insolvency. This presumption assists a creditor with an application to wind up the company in insolvency.

The winding up application process is very complicated with strict timelines and needs to be provided by a debt recovery and insolvency lawyer.

The process includes making the application with a supporting affidavit, other affidavits, notices to ASIC, and a consent of the liquidator.

If the application goes unopposed then it is likely that you will get the order winding up the debtor company in liquidation.

The liquidator will bring the company to an end and attempt to realise an many of the assets as possible, including voiding any voidable transactions, to make a payment of the debts or money owed to company creditors.

What can you do to legally recover debts owed to you?

To legally recover debts, the initial step involves negotiating with the debtor. This process can include highlighting potential legal remedies as leverage.

If negotiation fails, mediation or alternative dispute resolution methods can be employed. These methods aim to reach a mutually agreeable solution without resorting to litigation.

If these approaches do not yield results, legal action can be initiated in the appropriate court based on the amount owed.

Legal proceedings involve filing and serving a claim and statement of claim, and if uncontested, a judgment in default can be obtained for enforcement.

Some recommended approaches are:

- Negotiation – The first step is to try and resolve the issue by talking to the person who owes you money. This can lead to a faster, cheaper, and more amicable resolution than going to court. If needed and in certain situations, free mediation services may be available.

- Letter of Demand – If direct negotiation fails, the next step is to send a letter of demand. This letter should detail the amount owed or describe the property to be returned, outline the steps already taken to recover the money or property, specify a deadline for payment or return, and mention the actions you will take if the debt is not settled.

- Legal Action – If these efforts do not lead to an agreement, you can consider legal action. The courts in Queensland have varying monetary jurisdictions: the Magistrates Court handles debts up to $150,000, the District Court from $150,000 to $750,000, and the Supreme Court for amounts over $750,000.

There are also a number of risks associated with going to court, such as the potential for high costs and time consumption, with no guarantee of recovering the money. Additionally, you should consider the importance of considering whether the debtor is in a financial position to pay the debt.

There are time limits for initiating legal action in the Courts, typically within six years of the debt occurrence, though exceptions exist. If you decide to pursue legal action, it’s your responsibility to prove your claim, and you may be liable for the other party’s costs if you can’t prove it. The court does not take responsibility for pursuing your claim; this remains your obligation.

Recovering Debts or Money Owed: What you need to know

The initial step in debt recovery is to issue a letter of demand to the debtor. This letter should clearly state the total amount of the debt, the basis for its existence, and a warning that legal action may follow if the debt is not settled within a specified period (usually 7-14 days).

In Australia, debt recovery can also be pursued through tribunals like the Queensland Civil and Administrative Tribunal (QCAT) for minor debts under $25,000.

This option is less expensive and faster than court proceedings.

However, it’s important to note that QCAT generally operates as a no-costs jurisdiction, meaning recovery of legal costs is limited.

If a decision is made in your favour in QCAT, it can be registered in the Magistrates Court as an enforceable money order.

For enforcement, various warrants can be issued, such as those for seizure and sale of property, redirection of debts, and redirection of earnings.

Each type of warrant has specific requirements and is best pursued with legal advice.

Debt recovery is an essential aspect of financial management, involving the process of reclaiming funds owed by a debtor to a creditor. This process is legally enforceable in Australia, and understanding it is crucial for both individuals and businesses.

Understanding Debt and Its Recovery

A debt typically arises when a debtor fails to repay borrowed money or pay for goods and services by the due date. It’s important to distinguish between clear legal liabilities and disputed payments, as the latter may not be suitable for standard debt recovery procedures.

For instance, if there’s a disagreement over the completion or quality of a project, this might be a matter of contract breach or negligence rather than straightforward debt.

Initiating Debt Recovery

The first step in recovering a debt is to send a letter of demand to the debtor. This letter should clearly state the debt amount, the circumstances under which it became due, and a deadline for payment. It should also warn of legal proceedings if the debt is not settled by the specified date.

Choosing the Right Legal Forum

If the debtor does not respond or refuses to pay, legal proceedings can be initiated.

The choice of court or tribunal depends on various factors, including the debt’s origin, amount, and nature.

For example, the Queensland Civil and Administrative Tribunal (QCAT) handles debt disputes under $25,000 related to specific issues like unpaid invoices or loans.

In contrast, the Victorian Civil and Administrative Tribunal (VCAT) deals with disputes related to unpaid goods or services but does not handle general debt recovery matters.

Jurisdictional Limits

Each state and territory in Australia has courts with different jurisdictional limits. For instance, the Supreme Court of Western Australia hears civil matters involving disputes over $750,000, while in South Australia, civil disputes of $100,000 or above may be heard in either the District Court or the Supreme Court.

Debt Recovery Procedures: The specific procedures for debt recovery vary depending on the court or tribunal. It’s advisable to consult a lawyer to ensure compliance with the correct procedures.

Alternatives to Litigation

Before resorting to litigation, creditors are encouraged to negotiate with debtors. In some cases, state and territory government departments offer dispute resolution services, which can be a valuable resource.

In summary, debt recovery in Australia is a structured process that requires understanding the nature of the debt, initiating appropriate communication, choosing the right legal forum, and following specific procedures. Negotiation and alternative dispute resolution are recommended first steps before proceeding with litigation. For legal advice or representation, it’s advisable to consult professionals who specialize in this field.

Someone owes me money – What can I do?

When faced with the challenge of recovering money owed to you, it’s important to understand the steps you can take to effectively manage the situation.

As a creditor, you have several options to pursue the debtor for payment.

Initial Steps in Debt Recovery

The first course of action is to directly contact the debtor and attempt to negotiate a new agreement.

If this fails, the next step is to send a letter of demand. This letter should clearly state the amount owed and the consequences of non-payment, including potential legal action.

For debts involving a company, it’s advisable to seek legal advice due to the additional options available.

Recovering Debts or Money Owed by Taking Legal Action

If the debtor continues to refuse payment, legal action may be necessary.

For disputes involving a fixed sum of money less than $25,000, you can apply to the Queensland Civil and Administrative Tribunal (QCAT).

For amounts exceeding $25,000, the case should be taken to court.

The specific court (Magistrates, District, or Supreme Court) depends on the amount in dispute.

Navigating QCAT and Court Procedures

QCAT offers an accessible, quick, and cost-effective way to handle debt disputes.

It provides guidance on steps to recover your money and the application process.

For court proceedings, the process varies based on the court’s jurisdiction.

It’s crucial to understand the procedures for lodging your claim, defending it, and enforcing a judgment.

Recovering Debts or Money Owed by Enforcing a Money Order

If a court or tribunal rules that the debtor owes you money, they will issue a money order.

If the debtor still refuses to pay, you must apply to the court to enforce this order.

QCAT and Queensland Courts offer resources on how to enforce decisions and recover your money.

Time Limits for Enforcement

There is a time limit of 6 years (extendable to 12 years in some cases) to enforce a court or QCAT order.

If the debt is older than 6 years, legal advice is recommended.

Seeking Legal Advice for Recovering Debts or Money Owed

Legal advice is beneficial if you’re considering applying to QCAT or court for a debt dispute or if you have a court order that the debtor is not honouring.

Legal Aid Queensland and community legal centres can provide advice on personal debt recovery.

For business-related debts, consulting a private solicitor is advisable.

Additional Resources for Recovering Debts or Money Owed

Various organizations, including the Australian Competition and Consumer Commission (ACCC), Australian Securities and Investments Commission (ASIC), Australian Financial Security Authority (AFSA), and Office of Fair Trading, provide guidelines and information on debt collection and consumer rights.

In summary, recovering money owed involves a structured approach, starting with direct negotiation and escalating to legal action if necessary.

Understanding the legal framework and seeking appropriate advice are key to successfully managing debt recovery.

Recovering Debts or Money Owed for small business

For small businesses, managing and recovering small business debts is a crucial aspect of maintaining healthy cash flow and profitability.

Here are key strategies and resources for effective debt recovery:

Preventing Bad Debts:

- Conduct background checks on customers before engaging in business.

- Require payment before dispatching goods or providing services.

- Offer clear and straightforward payment options.

- Invoice promptly and consider incentives for early payment.

- Set reasonable credit limits for customers.

Recovering Outstanding Debts:

- Review contract terms to determine due dates for payments.

- Monitor payments regularly and follow up on overdue accounts.

- Send written payment requests to delinquent customers.

- Keep detailed records of all correspondence with customers.

- Issue formal letters of demand for unpaid debts.

- Consider employing a debt collection agency for persistent non-payment.

- Explore legal action as a last resort, including property searches on the Personal Property Security Register (PPSR) for unpaid goods.

Legal Avenues for Debt Recovery:

- Assess the cost and potential success of pursuing debts legally.

- For disputes under $25,000, consider the Queensland Civil and Administrative Tribunal (QCAT).

- For larger amounts, approach the appropriate court (Magistrates, District, or Supreme Court).

- Utilize small business commissioners, ombudsmen, community legal centers, and legal aid commissions for advice and low-cost dispute resolution.

- For higher-value disputes, consider district, county, and supreme courts.

- Engage private legal counsel for tailored advice and court case management.

Using Debt Collection Agencies:

- Debt collection agencies can save time and effort but may charge a portion of the recovered amount.

- Ensure that the agency holds a valid credit license.

Enforcing Court Orders:

- Be aware that obtaining a court order or judgment for debt payment is only the first step; enforcing the order may involve additional costs and efforts.

It’s important for small businesses to balance the cost and time of debt recovery against the likelihood of successful repayment.

Professional advice can be invaluable in navigating these challenges. Remember, even with a court order, enforcing payment can be complex and may incur further costs.

For more detailed information on debt collection rules and practices, refer to the Australian Competition and Consumer Commission (ACCC) website.

What are my options if I’m owed money? Will I recover it?

When owed money, your options include negotiation, mediation, court proceedings, or filing a claim in QCAT for minor debts.

The likelihood of recovery depends on the debtor’s financial situation and the effectiveness of the enforcement methods chosen.

Enforcing a judgment through warrants or bankruptcy proceedings can increase the chances of recovery, but there are no guarantees.

It’s important to weigh the costs of legal action against the potential recovery and to seek legal advice to understand the best course of action in your specific situation.

How Do I Recover a Debt From an Individual?

Recovering a debt from an individual can be a challenging process for businesses.

However, there are structured steps you can take to increase your chances of recovering the owed amount.

Initial Contact with the Debtor

The first step in debt recovery is to contact the debtor, typically through email and phone.

This initial contact is crucial to remind them of the overdue payment and to understand any reasons for non-payment.

It’s possible that the debtor may have overlooked the invoice or is facing financial difficulties.

Issuing a Letter of Demand

If the debtor does not respond or refuses to pay, the next step is to send a formal letter of demand.

This letter, often drafted by a lawyer, should clearly outline the total debt owed, confirm that the goods or services were provided, set a final date for payment, and state the actions you will take if the payment is not made by the specified date.

Including a copy of the invoice with the letter is advisable.

Considering a Settlement

In cases where the debtor disputes the debt or is unable to pay the full amount, you might consider a commercial settlement.

This could involve accepting a lesser amount or agreeing to a payment plan. It’s important to document any settlement agreement to prevent future disputes.

Recovering Debts or Money Owed by Taking Legal Action

As a last resort, you may need to initiate legal proceedings.

This step should be carefully considered due to the time, cost, and uncertainty involved.

The outcome of legal proceedings can vary, depending on whether the debtor defends the claim and the court’s decision.

Recovering Debts or Money Owed by Enforcing a Judgment

If you obtain a judgment debt, you can enforce it through legal means, such as seizing the debtor’s assets, garnishing their salary or bank account, or initiating bankruptcy proceedings for debts over $10,000.

While additional legal costs incurred during enforcement will be added to the judgment debt, there is still no guarantee of payment.

Key Considerations in Recovering Debts or Money Owed

It’s crucial to weigh the risks and costs of legal proceedings against the benefits of a settlement.

Sometimes accepting a reduced amount can be more beneficial than pursuing the full debt through court.

In summary, recovering a debt from an individual involves a series of steps, starting with direct communication and escalating to legal action if necessary. It’s important to approach each step realistically and consider the commercial implications of pursuing legal action. For professional advice and assistance with debt recovery, consulting with legal experts is recommended.

Recovering Debts or Money Owed FAQ

Welcome to our comprehensive FAQ section, where we address your most pressing questions about debt recovery and the legal processes involved.

Find insightful answers and expert guidance to navigate the complexities of reclaiming debts or money owed to you.

What is the first step in Recovering Debts or Money Owed?

The initial step in debt recovery is to negotiate directly with the debtor. This involves discussing the debt and seeking a mutually agreeable solution. It’s important to use potential legal remedies as leverage but only mention actions you’re legally entitled to take. This approach can lead to a quicker and more amicable resolution than legal proceedings.

How can a compromise or settlement help in debt recovery?

Compromising or settling can be an effective way to resolve a debt matter. It involves agreeing to accept a lesser amount than what is owed, or setting up a payment plan. This method is often more cost-effective than going to court, as it saves on legal fees and time. It’s important to document any agreement to avoid future disputes.

What is the role of mediation in Recovering Debts or Money Owed?

Mediation serves as an alternative to court proceedings, involving a neutral third party to help resolve the dispute. The goal is to reach a legally binding agreement that satisfies both parties. Mediation can be a less confrontational and more cost-effective method than going to court, and it often leads to a faster resolution.

When should I file a claim in court for Recovering Debts or Money Owed?

Filing a claim in court should be considered if other methods, like negotiation and mediation, fail. The choice of court depends on the debt amount: Magistrates Court for debts up to $150,000, District Court for $150,000 to $750,000, and Supreme Court for amounts over $750,000. Legal action should be a last resort due to its complexity and potential costs.

What is a statutory demand for Recovering Debts or Money Owed?

A statutory demand is a formal request issued to a company to pay a debt over $4,000. It’s used when the company is presumed insolvent. The company has 21 days to respond to the demand. Failure to comply can lead to legal presumption of insolvency and potential winding up or liquidation proceedings.

How can I enforce a court judgment for debt recovery?

Once a judgment or enforceable money order is obtained, you can enforce it through various warrants. These include seizure and sale of the debtor’s property, redirection of debts, and garnishee orders on salaries or bank accounts. Enforcing a judgment requires adherence to legal procedures and may involve additional costs.

What does bankruptcy involve in Recovering Debts or Money Owed?

Bankruptcy is initiated for individual debtors with debts over $10,000. It involves applying for a bankruptcy notice and, if the debtor fails to comply, presenting a creditor’s petition for a sequestration order. Bankruptcy lasts for three years, during which a trustee manages the debtor’s estate to recover funds for creditors.

What are the risks of going to court for debt recovery?

Going to court is risky, time-consuming, and potentially expensive. There’s no guarantee of a favourable outcome, and even with a strong case, you might not succeed. If unsuccessful, you may have to pay the legal costs of the other party. It’s important to weigh these risks against the potential benefits.

How does the Queensland Civil and Administrative Tribunal (QCAT) assist in debt recovery?

QCAT is an option for recovering minor debts under $25,000 in Queensland. It offers a quicker and less expensive process than court proceedings. However, it’s a no-costs jurisdiction, meaning you can’t recover legal costs. Decisions made by QCAT can be registered and enforced as court orders.

What should be included in a letter of demand?

A letter of demand should clearly state the total debt owed, confirm that the goods or services were provided, set a final date for payment, and outline the actions you will take if the payment is not made by the specified date. It’s a formal request and often the precursor to legal action if the debt is not settled.

When should I consider hiring a debt collection agency?

Hiring a debt collection agency is an option if the debtor continues to refuse payment after receiving a letter of demand. Agencies can save time and effort in pursuing the debt, but they typically charge a fee or a percentage of the recovered amount. Ensure the agency is licensed and reputable.

What are the time limits for enforcing a court order or QCAT decision?

You have up to 6 years, extendable to 12 in some cases, to enforce a court order or QCAT decision. If the debt is older than 6 years, it’s advisable to seek legal advice. Time limits are crucial in debt recovery, and missing them can bar you from pursuing the debt.

Is legal advice necessary for Recovering Debts or Money Owed?

Seeking legal advice is beneficial, especially if you’re considering court action or dealing with a complex debt situation. Legal experts can provide guidance on the best course of action, help with drafting documents, and offer representation if needed. They can also advise on the viability and risks of your case.

What should I do if a debtor disputes the debt or can’t pay in full?

If a debtor disputes the debt or can’t pay the full amount, consider negotiating a settlement. This might involve accepting a reduced amount or agreeing to a payment plan. It’s important to document any new agreement to prevent future disputes and to be realistic about the likelihood of recovering the full amount.

How can I prevent bad debts in my business?

To prevent bad debts, conduct thorough background checks on customers, require payment before delivering goods or services, offer clear payment options, invoice promptly, and set sensible credit limits. These proactive measures can significantly reduce the risk of bad debts and protect your business’s financial health.